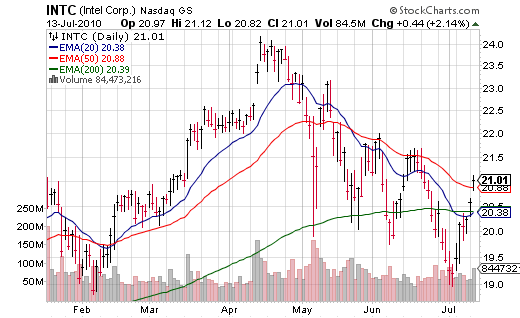

Intel (INTC) Does Its Part – Beat, Good Guidance, Record Margins. All Systems Go for Gap Up Tomorrow

Perhaps we are setting up for a repeat of summer 2009? [Are We Setting Up for a Repeat of Summer 2009?] All that is missing is a Goldman Sachs (GS) report Thursday with Meredith Whitney showing up on CNBC tomorrow morning saying she is bullish on banks.

Intel (INTC) did its part (guidance being the key since it is almost “in the bag” these companies will crush earnings), and key resistance on the S&P 500, rather than being fought during normal market hours, should be danced over in the premarket. Already we saw a big reaction at 4:15 PM. All systems go – the next key resistance area is S&P 1120, and then the highs of last month of 1130. A move over that level is key for bulls as it would mark the first new high in a while. I shall be selling long exposure tomorrow morning into the jubilee. The next level of interest for me on the long side is a clearance of S&P 1130.

Intel has posted its biggest profit in a decade as the company benefits from a strengthening computer market and more sophisticated factories. Intel Corp. reported after the market closed Tuesday that net income was $2.89 billion, or 51 cents per share, in the quarter ended June 26. That compares with a loss of $398 million, or 7 cents per share, a year ago. Analysts have expected a profit of 43 cents per share.

Revenue was $10.77 billion in the latest period. Analysts surveyed by Thomson Reuters expected $10.25 billion.

Gross margin was 67%, well above the guidance range of 62%-66%.

Intel’s revenue forecast of $11.20 billion to $12 billion for the third quarter is higher than analysts’ projections for $10.92 billion.

In a statement, CEO Paul Otellini said that strong demand from corporate customers drove “the best quarter in the company’s 42-year history.”